Reason being, you need to know the total amount of income and expenses you’ve incurred.

You’ll need to summarize all those transactions in the form of a balance sheet and income statement in order to file your taxes (particularly if you’re a corporation). It’s best to do this with your bank statements and your credit card statements, making sure every transaction is accounted for on your books. Reconciling helps you know for sure you’ve recorded every transaction properly. Get in the habit of cross referencing transactions in your bank statements with transactions in your company records to ensure everything is accounted for. If there are any discrepancies between your bank statements and your bookkeeping records, it’s best to catch these as soon as possible. Reconcile your books with your bank accounts

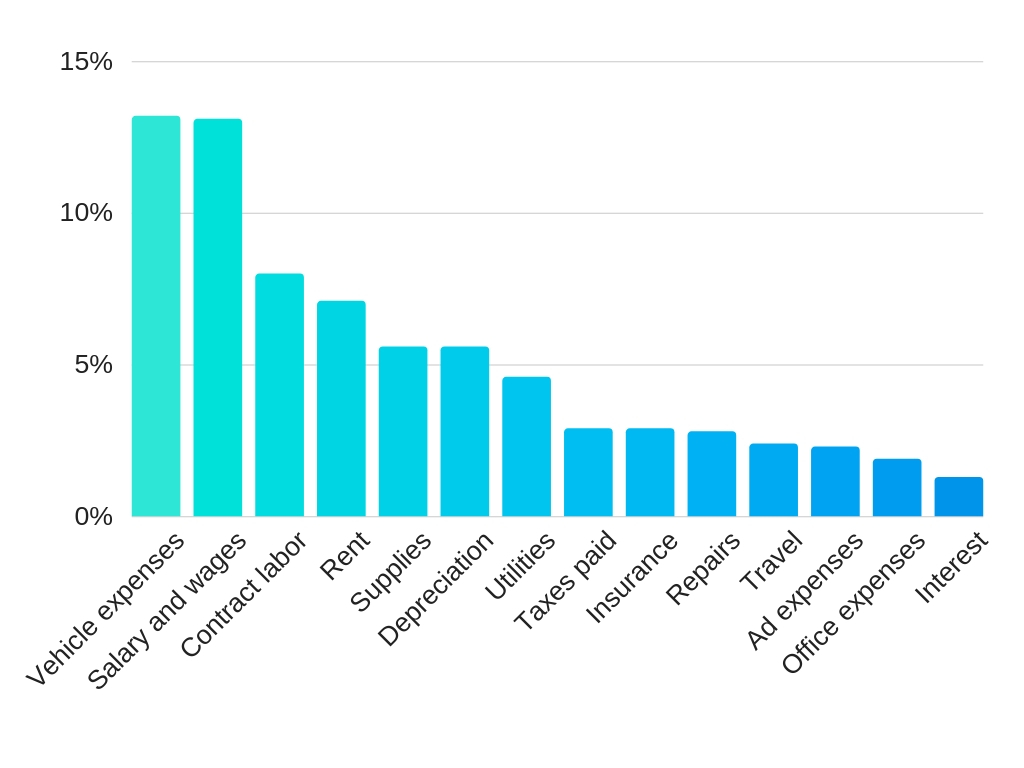

The important thing is that you record the amount, what category it falls under, the date, and a short description of what the transaction was for.Ģ. You can use accounting software, or an Excel template. But starting from the first day of the tax year, going back to January 1, you’ll need to record and categorize every single business transaction. This is the hardest part, and it will take you a long time.

Record and categorize every business transaction from your tax filing year Or, you can do it yourself by following these steps:ġ. You can hire Bench to get you caught up, fast. If your books are a mess right now, that’s okay. Accurate and up-to-date bookkeeping is possibly the most important ingredient for a stress-free tax season.

0 kommentar(er)

0 kommentar(er)